26+ biweekly mortgage payment

At that rate by the end of the. Lets pretend youve got a 30-year fixed mortgage.

Homeowners How Long Is Your Current Mortgage Term R Ireland

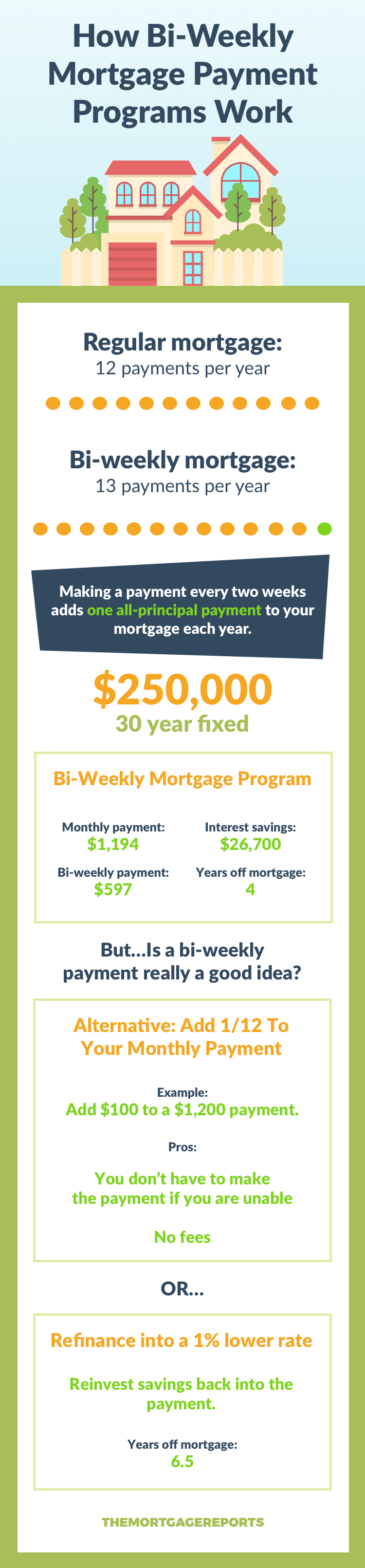

Web A bi-weekly payment plan uses the calendar year to your advantage.

. You are in effect adding an extra payment to your mortgage equal to one more month. Find A Lender That Offers Great Service. Ad Compare Mortgage Options Calculate Payments.

There will be 2 months during the year when a 3rd half-payment will be drafted and posted to your. Try our mortgage calculator. Lock Your Mortgage Rate Today.

Web If you pay your mortgage monthly like most homeowners youre making 12 payments a year. Compare More Than Just Rates. This significantly accelerates the loans payback by making 13 complete payments over 12 months.

There will be 26 withdrawals a year. By paying half of your mortgage payment every two weeks you make 26 payments per year instead of 12. This adds up to 26 payments or 13 full payments per year.

Ad Calculate Your Payment with 0 Down. Web Biweekly payments mean you pay off your loan 4 years and 3 months early by making the equivalent of one extra payment per year. There will be 2 months during the year when a 3rd half-payment will be drafted and posted to your.

Web Monthly to Biweekly Loan Payment Calculator with Extra Bi-weekly payments can be an effective way to pay off your mortgage faster. Web Simply by performing the steps of switching to biweekly payments and directing an additional 50 monthly to your mortgage you can reduce its length from 30 years to 23 years and eight months. Biweekly AutoPay will automatically draft a half-payment from your account every 2 weeks 14 days.

Web The biweekly method drastically decreases the amount of interest you pay for your home. Web If you pay biweekly youll make half of your monthly principal and interest payment every two weeks instead. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Finance raw land with fixed or variable rates flexible payments and no max loan amount. When you enroll in a biweekly payment program youre paying half your monthly amount once every. If your monthly payment were 2000 per month under one of these payment plans youd.

Average interest each biweekly period 000. There will be 26 withdrawals a year. Were Americas Largest Mortgage Lender.

Web With biweekly payments. Web With a biweekly mortgage the borrower makes 26 half payments every two weeks. Because some months are longer than others you end up making an extra monthly.

When you make biweekly payments you could save more money on interest and pay your mortgage down faster than you would by. The additional annual payment can result in significant interest cost savings for. Try our mortgage calculator.

Ad Get an idea of your estimated payments or loan possibilities. Web Over the course of a year you will make 26 payments of 35076 totalling 9120 whereas with 12 standard monthly. Not only will switching to biweekly payments save you time on the life of your loan but it can also.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web A biweekly mortgage payment plan involves making half of that mortgage payment or 104750 every two weeks for a total of 26 payments each year. Thats 26 half payments a year or the equivalent of 13 full payments a.

Paying your mortgage as quickly as possible can save you tens. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. If you take 500 and multiply it by 26 payments you have 13000 in total payments.

Web Biweekly mortgage payments There is an alternative to monthly payments making half your monthly payment every two weeks. Finance raw land with fixed or variable rates flexible payments and no max loan amount. Web Rather than 24 semi-monthly periods you make payments over 26 biweekly periods.

Ad Get an idea of your estimated payments or loan possibilities. That extra 1000 is applied directly to your principal reducing how much. How Much Interest Can You Save By Increasing Your Mortgage Payment.

And because your annual payment comes in 52 parts you also pay a much smaller amount. Web And because there are 52 weeks in a year that equates to 26 half payments annually or 13 total monthly mortgage payments. The idea is to make half of your monthly mortgage payment every two weeks rather than one full payment per month.

Biweekly AutoPay will automatically draft a half-payment from your account every 2 weeks 14 days. Web One way to pay off your 30 year mortgage in 15 years is to make bi-weekly payments. Apply Now With Quicken Loans.

Bi Weekly Mortgage Program Are They Even Worth It

Why You Should Consider Making Biweekly Mortgage Payments Vs Monthly Hassle Free Savings

Bi Weekly Mortgage Payments Will Help You Payoff Your Mortgage Faster Michaels Mortgage Blog

Biweekly Mortgage Calculator Calculate Accelerated Bi Weekly Home Loan Payment Savings

May 2022 Time To Money As A Competitive Advantage

Biweekly Mortgage Payment Problems The New York Times

Biweekly Mortgage Calculator

Pin On Template

Bi Weekly Mortgage Payment Calculator Bizcalcs Com

Biweekly Mortgage Payments Do They Make Sense For You Credible

Bi Weekly Vs Monthly Mortgage Payments Truth About Paying Your Mortgage Off Fast Youtube

The Benefits Of A Biweekly Mortgage Plan Mortgages The New York Times

Biweekly Mortgage Payment Calculator With Double Savings Feature

Pdf An Examination Of Juveniles Being Tried As Adults Influences Of Ethnicity Socioeconomic Status And Age Of Defendant Russ K E Espinoza Academia Edu

Bi Weekly Payment Calculator Keen Bank N A

The Mortgage Brothers Show Signature Home Loans Phoenix Az

Biweekly Payment Calculator Credit Union Mortgage Payoff Pfcu